Let’s take a look at the invoicing requirements for Australian Sole Traders.

Operating as a Sole Trader is the simplest business structure in Australia. Here we will break down and see exactly what invoicing for an Australian sole trader looks like.

Invoice requirements for Australian Sole Traders

Invoice requirements for a sole trader are the same as for any business or company operating in Australia.

If you make a taxable sale for $82.50 (including GST) or more, your GST-registered customers need a tax invoice from you. If your customer asks for an invoice, it must be issued within 28 days of the sale.

Let’s tick off the must-have invoice requirements for sole traders in Australia:

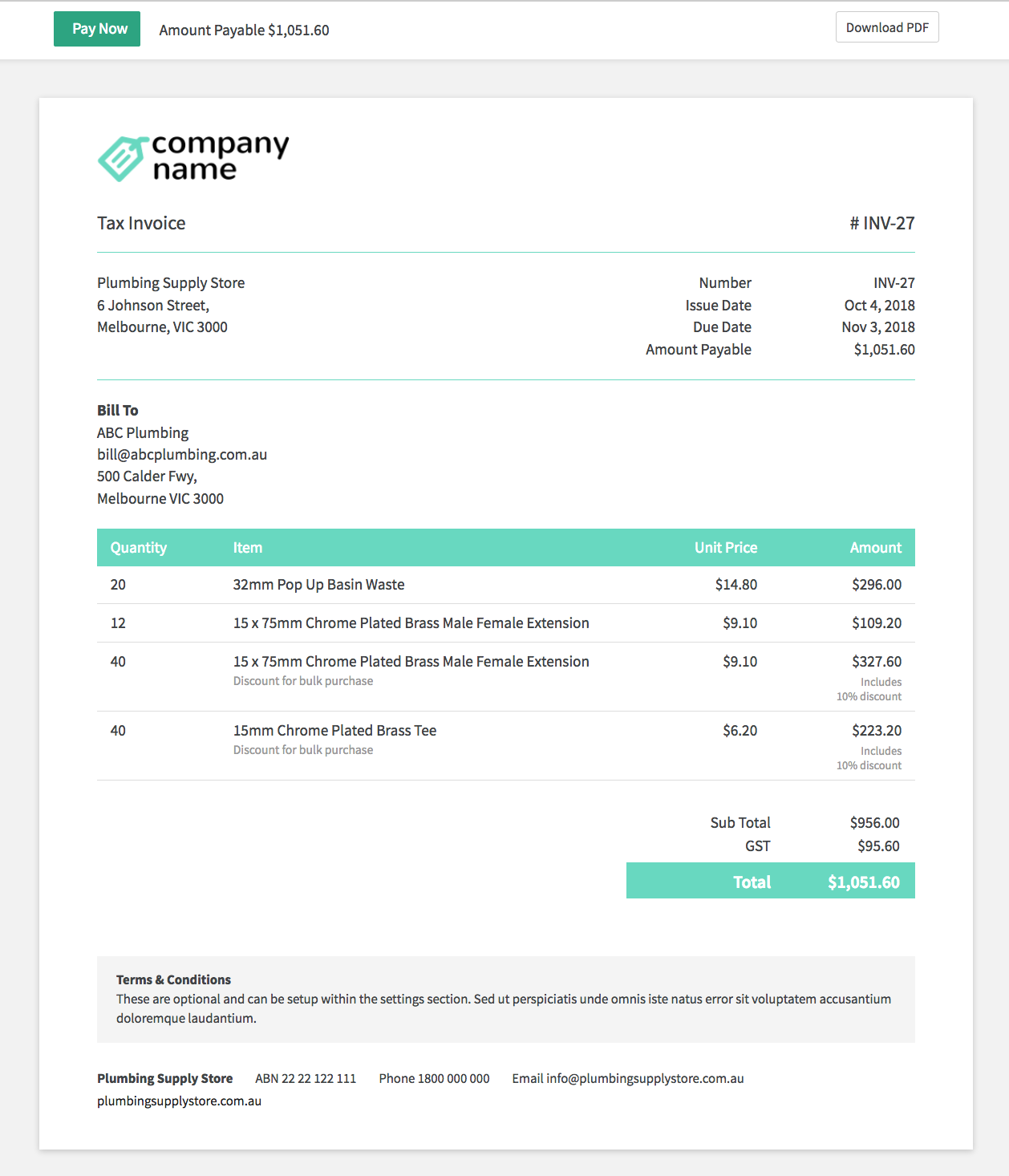

- The words Tax Invoice must be on the document

- ABN – your invoice must show your ABN (Australian Business Number)

- Your identity – Your business name or trading name

- The date – the issue date of the invoice

- Items sold – include a description, price and quantity

- GST – the amount of GST that is payable (if any)

- The extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST)

As well as the above items, your invoice also needs to include the buyers identity or ABN if the value of the invoice is over $1,000.

Can I issue my invoice electronically?

Yes, you can issue your invoice electronically (such as via email or with a link). You are not required to issue the invoice in a paper format.

Issuing the invoice to your client electronically is preferred to be done in PDF format, although it can be issued in any format as long as the invoice contains all of the information required for a tax invoice and is readily accessible.

Simple Invoices makes this easy to do. You can email your invoices to clients with just a few clicks and they will receive a link to the invoice and you also have the option of attaching the invoice in PDF format.

Taxable and non-taxable items

Some of your line items may be GST-free and some will be taxable. If your invoice contains bith taxable and non-taxable items on the same invoice, it is required that you show which items are taxable and which items are not. Simple Invoices can handle this option.

Does Simple Invoices have sole trader invoice templates?

Yes, all of our invoice templates are suitable for Australian sole traders.

Our invoice templates can be used by:

- Builders, carpenters, bricklayers, roofers

- Plumbers, gasfitters

- Electricians, auto eectricians

- Web designers, web developers, software developers

- Graphic designers, interior designers

- Freelancers of any kind

- Virtually any type of sole trader in Australia

- Check out our post on invoicing software for Aussie tradies.

Start your free trial today to check out our range of invoice templates for Australian sole traders and small businesses. Our invoice templates are simple, neat and clean.

Our free trial is a fully featured trial with no limitations.